Wise Winnie

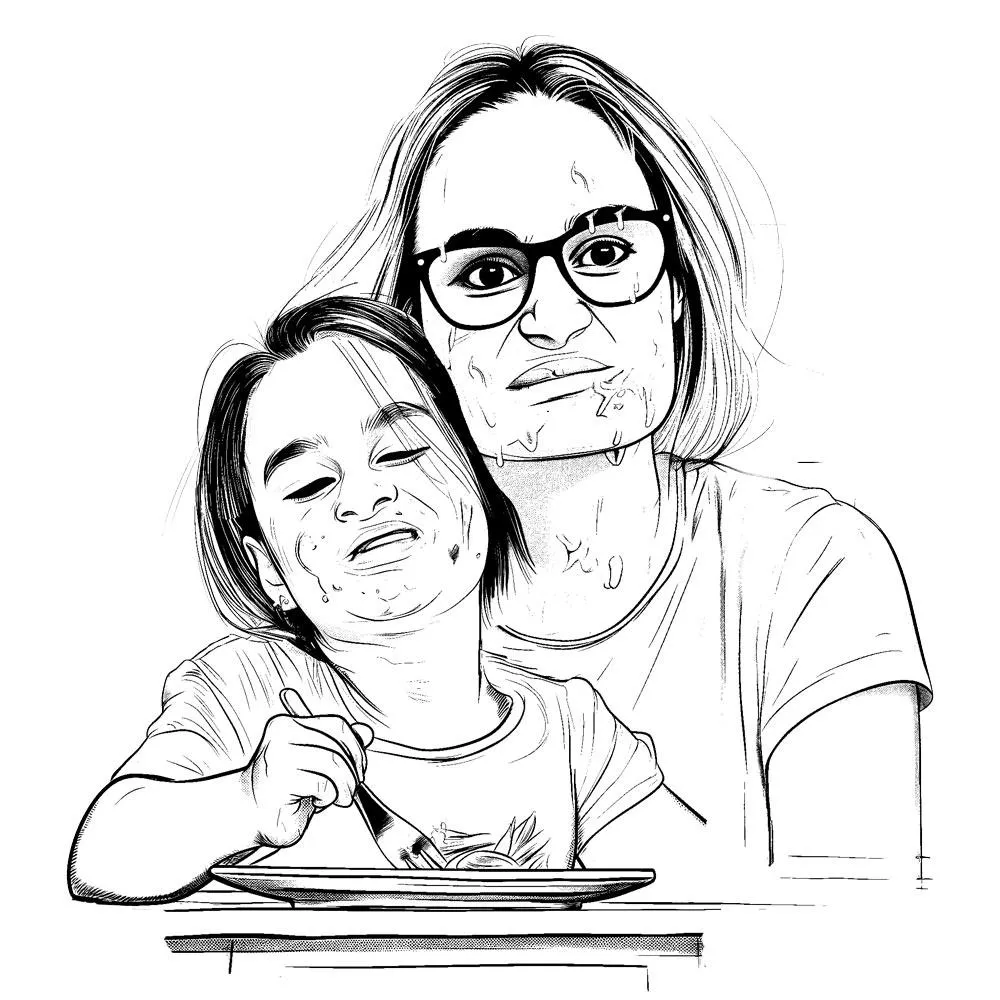

Worried About Family Finances, Moms?

Save Your Home, Rebuild Your Family Life & Credit Rating - Without Bankruptcy

Meet the little-known & rapid system Canadian families are discovering to protect their hard-earned way of life from looming financial ruin—in weeks not years.

*Government approved - hated by bankers & mortgage brokers

Moms, you’ve always been the protector, the one to fix things before they fall apart. But what happens when your family’s future is threatened by something you can’t fix by yourselves?

Your family deserves security, not endless worry. Meet the FDD system—a revolutionary way to protect your home and future from financial ruin.

Wise Winnie understands the invisible load you carry—managing your family’s needs, making sure they’re protected. But with bills card payments piling up, even supermoms need a hand.

You've tried budgeting, cutting back on expenses, but no matter how hard you try, those debts seem to grow bigger. What if the way you’ve been taught to tackle financial problems is actually keeping you stuck?

Introducing FDD, a proven system that redefines how families like yours can tackle debt without losing what matters most—your home and peace of mind. It's not about bankruptcy or cutting back; it's about using a strategy designed to protect what you’ve built

Introducing FDD, a proven system that redefines how families like yours can tackle debt without losing what matters most—your home and peace of mind. It's not about bankruptcy or cutting back; it's about using a strategy designed to protect what you’ve built

Got Questions?

What is a Short-Term Plan?

Short-term health insurance is designed to fill gaps in coverage. It’s ideal for people who are:

- Switching jobs and in between benefits.

- Waiting to be Medicare-eligible.

- Not qualified for an ACA plan, but will have other insurance in the near future.

- Transitioning from their parent's health insurance plan to their own.

Keep in mind, short-term medical plans aren’t required to meet the same guidelines as ACA plans.

Because of this, many don’t cover pre-existing conditions, including pregnancy.Some plans also have maximum payout amounts and waiting periods for coverage to begin. So, when choosing a short-term plan, it’s important to completely understand what is and isn’t covered before you buy

What should I ask the agent when I speak to them on the phone to ensure I get the plan I need?

When exploring your health plan options, you can ask the agent these questions to help determine if the coverage fits your needs.

- Is this a managed care or an indemnity plan?

- Is this plan ACA compliant?

- Is this a cost-sharing plan or is it real health insurance?

- Is this health insurance or a plan that supplements my current health insurance?

- How much money do I have to pay out-of-pocket annually for medical care?

- Is there a co-pay for doctor visits? If so, what is it? Is there a separate co-pay for specialists?

- Does this plan include dental, vision care, and other special services?

- Can I continue seeing my current doctors?

- Are preventative or routine exams covered?

- Does the plan cover pre-existing conditions? If not, what’s excluded?

- Are prescription costs covered?

- Does this plan have a deductible?

- If so, how much is it and when does it apply?

What is an Affordable Care Act (ACA) Plan?

The comprehensive healthcare reform law, known commonly as ACA or Obamacare, requires qualified insurers to provide individual health insurance plans to enrollees that meet the minimum essential coverage requirements. These plans are designed to make healthcare more affordable and to provide coverage to everyone, including those with pre-existing conditions.

With an ACA health plan, you pay a monthly premium and typically, a co-pay when you visit your doctor. When choosing your plan, it’s important to look at the deductible, which is the amount of money you pay before your insurance “kicks in,” and your out-of-pocket maximum, which is the total amount of money you pay annually before your insurance covers you 100%.

Also, keep in mind, that while all ACA health insurance plans include dental and vision coverage for children, they may not include it for adults. If you need vision and dental coverage, and your plan doesn’t include it, you’ll have to purchase it separately.

What is a Fixed Indemnity Plan?

Fixed indemnity plans aren’t traditional health insurance coverage. These plans are designed to supplement your health insurance by reimbursing you for out-of-pocket expenses you pay on covered medical treatments and procedures.

For example, if your health insurance has a $500 deductible for emergency room visits, this is what you pay if you receive treatment at the ER. Then, you can submit your receipts to the provider who manages your fixed indemnity plan for reimbursement.

Keep in mind, fixed indemnity plans don’t cover pre-existing conditions. In fact, they typically have a list of specific procedures and medical treatments that are covered, so make sure you understand when you’re reimbursed and when you aren’t before you buy.

Also, the amount of costs reimbursed to you could affect your Medicaid eligibility (if applicable).

What is a Community/Cost-Sharing Plan?

Community/cost-sharing plans are not real health insurance plans. These plans are designed to supplement your health insurance in an effort to help you manage costs.

When you purchase a cost-sharing plan, you aren’t buying health insurance. Instead, you’re buying into a community plan that pulls everyone’s monthly payments together and uses that money to help pay for its member’s out-of-pocket medical expenses.

Keep in mind, each program has specific guidelines. Before you buy, make sure you know what type of medical expenses you can get reimbursed for.

Copyright © Wise Winnie | 2024 | All rights reserved | 42 rue Jeanne Gleuzer, Colombes, 92700, France

*Possible plan options include, but are not limited to Major Medical Plans, Short Term Plans, Fixed Indemnity Plans, Community/Cost-Sharing Plans and more. Prices may vary based on plan types, location, and other factors.

*Pricing of $59/month is based off a 26-year-old male living in Miami, FL receiving a short-term health insurance plan. Prices may vary depending on plan types, location, and other factors.

*Pricing of $0/month is for qualifying individuals. Eligibility may change depending on location, household size, and income.